There are lots of reasons why a New Zealand investor would want to incorporate investments that provide a different risk/return profile to a broad market exposure, like the S&P 500 or MSCI World, into their portfolio core.

Depending on what else is in your portfolio, and your view of markets or financial objectives, you may prefer to include a fund that tilts towards value, growth or quality stocks, or a fund that aims to generate enhanced income or a defensive, lower volatility return profile.

One alternative for seeking a return premium or exposure beyond just the broad market beta is actively managed funds that employ ‘style biases’, such as structural overweight exposures to companies with high profitability or low price-to-book ratios.

These active managers will often highlight the importance of their unique expertise, research process and security selection in constructing their investment portfolio.

However, over the last twenty years, a whole new field in indexing has developed around factor or smart-beta investing.

And it turns out that factor investing targets the same risk premia that many active managers have long relied on. Investors can now get exposure to these risk premia through lower-cost funds that seek to track a rules-based factor index.

Regarding active managers that pursue a style bias, we have observed the following:

- Often, any ‘outperformance’ above broad market beta is in fact partially or fully attributable to a factor exposure rather than the manager’s stock specific bets (i.e. true alpha).

- The management costs of rules-based factor index funds are generally far lower than active funds.

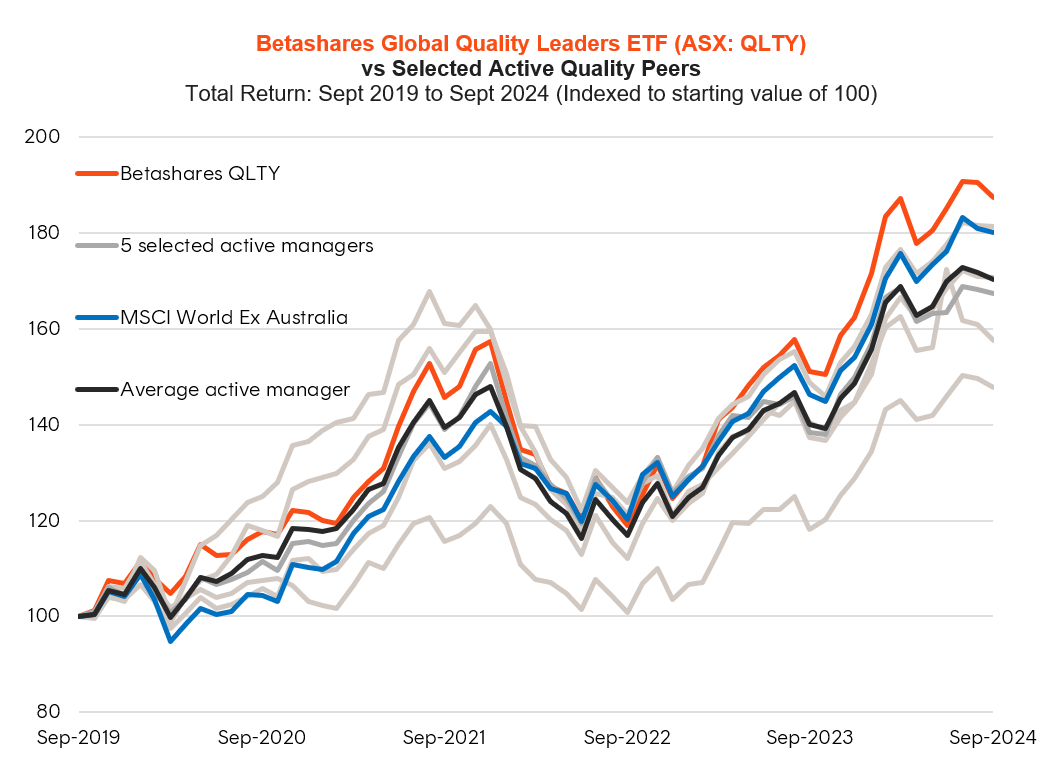

- Over longer investment time horizons, rules-based factor index funds have tended to outperform the majority of active funds with the same factor or style bias on a net-of-fee basis2.

The below chart compares the Betashares Global Quality Leaders ETF, whose index is also tracked by the Betashares Global Quality Leaders Fund which is available in New Zealand through a PIE fund structure, to large global active managers with a quality investing approach and can help to visualise some of these points.

Source: Morningstar. As at September 2024. Net of QLTY’s management fees of 0.35% p.a.. Total Return: Active Quality Peers selected from Australian domiciled global equity active funds with similar factor profile to QLTY (as determined by Betashares). You cannot invest directly in an index. Past performance is not indicative of future performance of any index or fund.

In addition, the systematic approach of rules-based factor index funds does not allow for a subjective active judgement call to allocate to cash or change investment styles, which would otherwise create the risk of unintentionally altering the strategic asset allocation for end investors.

Smart indexing equity ETFs to add balance to your portfolio

Betashares has a range of PIE funds that offer the best of both worlds – intelligent indexing for outperformance potential beyond broad market beta and the cost effectiveness typically expected of passive funds.

These core portfolio solutions include:

Betashares Global Quality Leaders Fund

Seeks to track an index (before fees and expenses) designed to provide diversified exposure to 150 of the world’s highest quality companies. Companies are evaluated based on four key quality characteristics designed to capture persistent, high profitability, and the fund is weighted to seek to avoid stock specific risk.

The annual fund charge is 0.49% p.a.*

Betashares Australian Investment Grade Corporate Bond Fund (NZD Hedged)

Smart beta indexing is not reserved for equities alone. The fund selects bonds based on expected returns rather than debt outstanding, seeking to avoid the shortcomings of traditional debt-weighted indices and provide higher returns.

The fund seeks to track an index that provides intelligent exposure to a portfolio of senior, fixed-rate, investment grade Australian issued corporate bonds, hedged into NZ dollars. Up to 50 bonds are selected, with a term to maturity of between 5.25 to 10.25 years, hedged into NZ dollars.

The annual fund charge is 0.34% p.a.*

Access investment styles without the high fees

Most active managers have continued to underperform broad market benchmarks. What is perhaps less appreciated is that certain investment styles pursued by many actively managed funds are in fact available through lower cost index funds, avoiding the need to pay high active manager fee loads.

Indeed, low-cost index-tracking funds, including broad market exposures, together with ‘smart-indexing’ exposures, can provide an excellent toolkit for building a strong core over the long term.

* Other costs, such as transaction costs, may apply. Refer to the applicable Product Disclosure Statement, available at www.betashares.co.nz, for more information.

There are risks associated with an investment in the Funds. Investment value can go up and down. An investment in the Funds should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Funds, please see the Product Disclosure Statement, SIPO and OMI available on this website.

Please note that the above illustration is not a recommendation to adopt any particular investment strategy and does not take into account any potential investor’s particular circumstances or tolerance for risk. No assurance can be given that a Smart Beta methodology will outperform a traditional market-cap weighted methodology over any time period.

Written by

Tom Wickenden

Tom Wickenden works as an investment strategist in Betashares investment strategy and research team. Tom is responsible for supporting both the sales and marketing teams across Betashares’ wide range of funds including all major asset classes. Prior to Betashares Tom worked in an accounting firm in London specialising in the fields of audit and forensic accounting. Tom has a Bachelor of Commerce majoring in Economics and Accounting from the University of Sydney and is currently a level 3 CFA candidate.

Read more from Tom.