Betashares Global Quality Leaders Fund

- International shares

Invest in a portfolio of 150 global companies ranked by highest quality score

Overview

Fund objective

The Fund aims to track an index (before fees and expenses) that comprises 150 global companies (ex-Australia) ranked by highest quality score.

Fund strategy

The quality score rankings used to select the stocks in the index are based on a combined ranking of four key factors – return on equity, debt-to-capital, cash flow generation ability and earnings stability.

Benefits

-

Access to the world’s highest quality companies

The Fund’s index has been designed to select quality global companies based on high return on equity and profitability, low leverage and earnings stability.

-

Outperformance potential

The Fund’s focus on quality aims to produce long-term performance superior to that of benchmark global equities indices, but without the high costs of active managers.

-

Diversification

The Fund provides access to a portfolio of high quality companies from a range of geographies and global sectors, many of which are under-represented in the Australian and NZ sharemarkets.

There are risks associated with an investment in the Fund, including market risk, index methodology risk, international investment risk, concentration risk and currency risk. Investment value can go up and down. An investment in the Fund should only be made after considering your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement, SIPO and OMI available on this website.

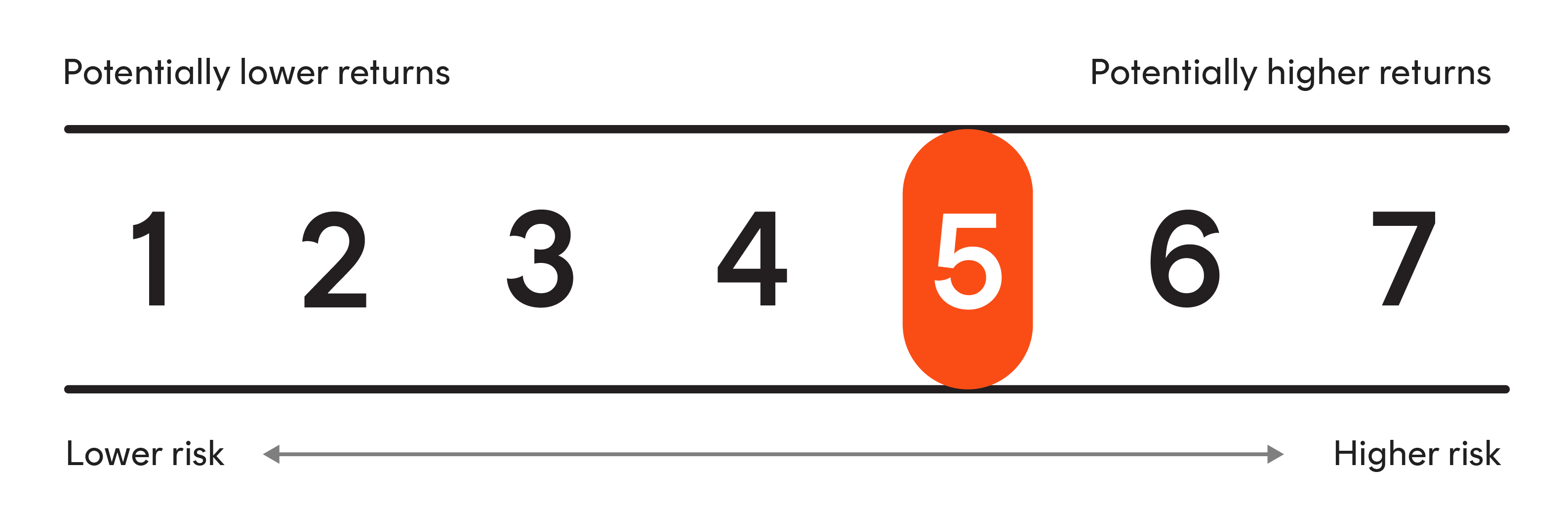

Risk indicator

The Fund is expected to have a very high level of volatility. See the PDS for more information regarding the risk indicator.

How to invest

- You can invest in Betashares NZ funds through an approved platform

- Contact us to enquire about direct applications (minimum investment $500,000)

Key facts

Profile

| NAV / Unit | $1.6631 |

|---|---|

| Net assets ($NZ) | $19,530,805 |

| Annual Fund Charges | 0.49% |

| Buy/Sell spread | 0.15% |

| Distribution frequency | N/A |

| Distribution reinvestment plan (DRP) | N/A |

| Manager | Betashares Capital NZ Ltd |

| Registry | MUFG Corporate Markets |

| Supervisor | Trustees Executors Limited |

Index information

| Index | iSTOXX MUTB Global Ex-Australia Quality Leaders Index |

|---|---|

| Index provider | STOXX |

| Index ticker | N/A |

| Bloomberg index ticker | ISMGRAN Index |

Holdings & allocation

Portfolio exposure

| Name | Weight (%) |

|---|---|

| LAM RESEARCH CORP | 2.8% |

| APPLIED MATERIALS INC | 2.7% |

| ASML HOLDING NV | 2.6% |

| PROCTER & GAMBLE CO/THE | 2.3% |

| JOHNSON & JOHNSON | 2.3% |

| HONEYWELL INTERNATIONAL INC | 2.2% |

| COSTCO WHOLESALE CORP | 2.2% |

| AMPHENOL CORP | 2.1% |

| NVIDIA CORP | 2.0% |

| TOKYO ELECTRON LTD | 2.0% |

* As at 26 February 2026.

As described in the PDS, the Fund may either invest directly and/or via an underlying exchange traded fund (ETF). The information above shows either the direct holdings of the Fund or the holdings of the underlying ETF on a look through basis which closely approximates the Fund’s percentage exposure to those investments.

Index sector exposure

| Information Technology | 32.7% |

|---|---|

| Industrials | 16.7% |

| Health Care | 15.4% |

| Financials | 10.0% |

| Consumer Discretionary | 9.9% |

| Communication Services | 7.6% |

| Consumer Staples | 7.0% |

| Energy | 0.5% |

| Materials | 0.1% |

| Other | 0.0% |

* As of 30 January 2026

Index country exposure

| United States | 70.2% |

|---|---|

| Japan | 11.4% |

| Netherlands | 4.5% |

| Switzerland | 3.7% |

| France | 3.2% |

| Hong Kong | 1.3% |

| Spain | 1.0% |

| Britain | 1.0% |

| Sweden | 0.9% |

| Other | 2.8% |

* As of 30 January 2026

Performance

Fund returns after fees (%)

| Fund | Index | |

|---|---|---|

| 1 month | -2.64% | -2.63% |

| 3 months | -2.50% | -2.43% |

| 6 months | 7.46% | 7.63% |

| 1 year | 5.86% | 6.19% |

| 3 year p.a. | - | 21.04% |

| 5 year p.a. | - | 14.34% |

| 10 year p.a. | - | 14.86% |

| Since inception (p.a.) | 19.96% | 20.14% |

| Inception date | 17-May-23 | - |

* As at 30 January 2026.

Past performance is not an indicator of future performance. Returns are calculated in New Zealand dollars using exit unit prices at the start and end of the specified period. Returns are after fund management costs, assume reinvestment of any distributions and do not take into account tax paid as an investor in the Fund. Returns for periods longer than one year are annualised. Current performance may be higher or lower than the performance shown.

Chart

Past performance is not indicative of future performance. Please refer to "Fund returns after fees" for additional information regarding performance/return information.